Using the Section 179 Tax Deduction to Benefit You

As a business owner or supervisor, you've spent plenty of time trying to find ways to help the company maximize its resources and be more efficient with costs. As we come up to tax season, you may be looking for ways to lessen your tax burden and put more cash back into the business. For many, Section 179 of the IRS tax code is a way to do both.

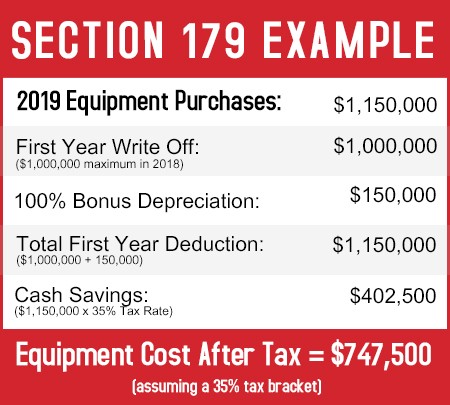

Although Section 179 has been around for quite a few years and has undergone changes during that time, that main gist of Section 179 stays the same: It allows qualifying businesses to deduct the full purchase price of new and used equipment for the year it was purchased, rather than using the standard depreciation method. This change to the tax code was intended to help businesses invest more heavily into purchasing and leasing equipment and other qualifying items to improve the business.

How Section 179 is Different from Standard Depreciation?

There is a good size list of items that qualify for Section 179 – everything from computer equipment to some construction improvements – but for our purposes, let's look at material handling equipment. Almost all material handling equipment qualifies for Section 179 and it can be used equipment, as long as it is "new" to you. Outright purchasing qualifies, as well as financing. So, if you've had your eye on a piece of equipment – from a forklift, aerial lift, floor cleaning equipment or even a utility vehicle – you should probably look at Section 179 to see if it presents an advantage to you. If it makes more sense to take Section 179 and recoup the full deduction in the year it was purchased, then Section 179 may be for you. In contrast, deducting the price of a piece of equipment by, for example, 10% over 10 years in standard depreciation models leaves many with a used piece of equipment that isn't worth the book value anymore by the time it's been fully depreciated.

What are the Limits of Section 179?

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.